In 2022, a UN resolution was passed calling for the creation of a new international cooperation framework to fight tax abuse – which France has been reticent to agree to on grounds that the OECD instead was the relevant forum. This take shared by TJN’s Chief executive Alex Cobham who, when contacted by EURACTIV, said that France had “left itself open to a charge of hypocrisy” by “actively seeking to block global progress on tax at the United Nations”.

“Member states shy away from going head-to-head with tax havens, and properly fight tax evasion,” he told EURACTIV, blaming France for its lack of ambition at the EU level, and in international OECD negotiations over a minimum corporate tax on multinationals. To Damien Carême, a French green MEP and rapporteur for the EU Anti-Money Laundering package, the announcements also fall short of anything concrete. The tool is rarely used for fear of costly litigations, though it sits at the heart of the original 2016 Anti-Tax Avoidance Directive (ATAD), and was transposed by all member states in 2018. Unlike what the government proposes, she calls for a larger and swifter use of General Anti-Avoidance Rules (GAARs), designed to strike down otherwise-legal international practices that companies engage in for the sole purpose of dodging taxes. The MP said that she cannot help but see the new plans as a communications stunt, as the government tries to ease tensions over the recently-adopted pensions reform, a hotly contested piece of legislation that brought millions to the streets. While most of the focus is on tax fraud – policing those that misbehave – the plan is light on anything regarding tax evasion, the practice of which is rooted in legal loopholes in national and international legislation, making it legal, “though unacceptable”, Leduc explained. “There is a lot of interesting announcements, but it lacks ambition,” far-left MP and the National Assembly’s special rapporteur on tax evasion Charlotte Leduc told EURACTIV. An offensive stance against tax evasion can help assuage growing political frustration. The ongoing inflationary crisis is marred by the ever-growing gap between people’s falling purchasing power and EU multinationals’ posting record-high profits. The key to winning back people's trust: Tax multinationals For the EU, this figure is €1 trillion every year, according to estimates from the European Commission.įor France, specialised NGO the Tax Justice Network (TJN) found that $40 billion (€36.5 billion) go missing yearly. While this is a welcome move, Solidaires Finances Publiques trade union noted that there have been 21,000 job cuts in the French financial administration since 2012, including 3,000 in fiscal departments.īoth scholarly and political communities contest the true value of state revenue lost due to tax evasion. The minister vowed to recruit up to 1,500 agents dedicated to fighting tax fraud as a part of a new dedicated intelligence unit. “Each fraud is reprehensible, but that of the most powerful is unforgivable,” French public finance minister Gabriel Attal told Le Monde on Monday, announcing that those found guilty of malpractice will be imposed hours of community service.įor the worst offenders “who chose to ignore their obligations as French citizens”, additional measures to temporarily take away their voting rights will be taken, Attal added. The measures look to increase tax fraud checks by 25% between now and 2027 on the highest earners, while the 100 largest multinationals will undergo administrative checks every other year.

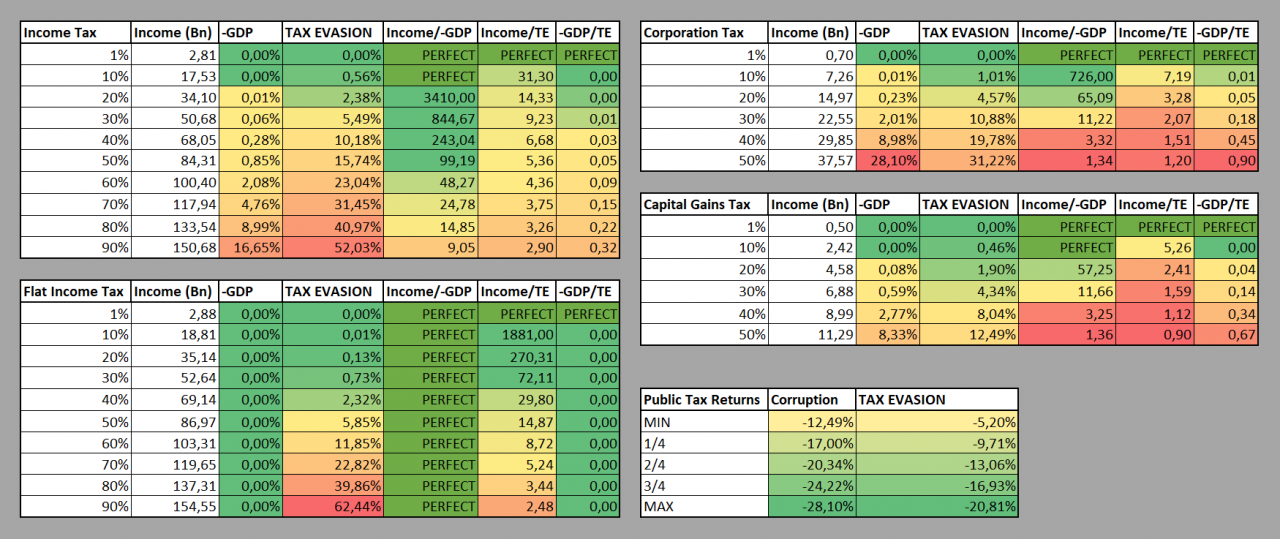

#Democracy 3 tax evasion series#

A series of measures were presented by the French government on Tuesday (9 May) to fight tax fraud committed by both individuals and multinationals, though the plan lacks ambition and fails to tackle the problem at its roots, experts warn.

0 kommentar(er)

0 kommentar(er)